-

أخر الأخبار

- استكشف

-

الصفحات

-

المدونات

-

Courses

-

الافلام

Europe Treasury Software Market Landscape: Size, Share, Segments & Trend Analysis to 2030

"Future of Executive Summary Europe Treasury Software Market : Size and Share Dynamics

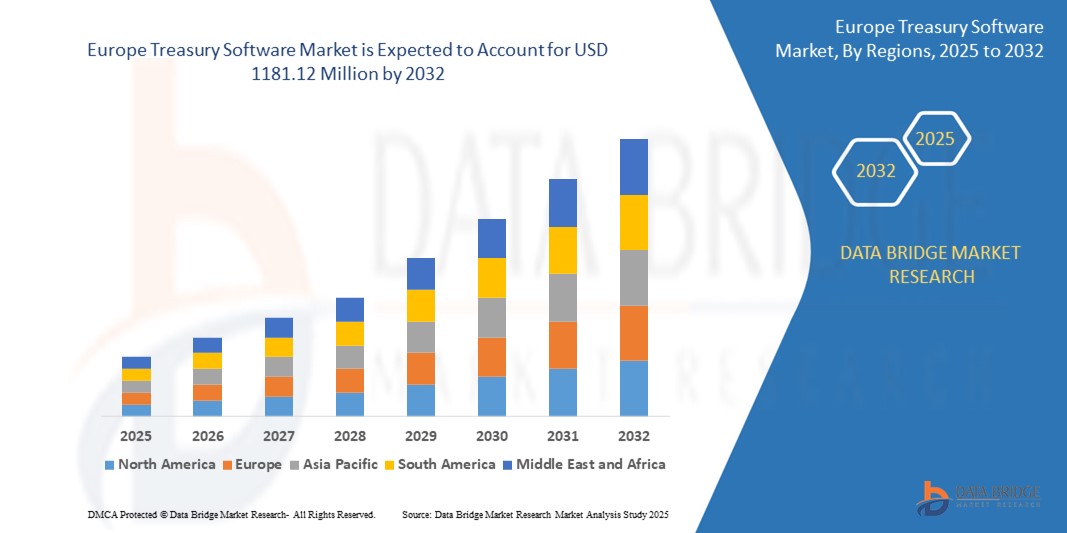

The Europe treasury software market size was valued at USD 939.66 million in 2024 and is expected to reach USD 1181.12 million by 2032, at a CAGR of 2.90% during the forecast period

Businesses can attain detailed insights with the large scale Europe Treasury Software Market survey report which help them self-assuredly make decisions about their production and Market strategies in Europe Treasury Software Market industry. The report describes various parameters throughout which analyses the market status in detail. It also endows with statistics on the current state of the industry and hence works as a valuable source of guidance and direction for companies and investors interested in this market. The whole Europe Treasury Software Market report can be mainly categorised into four main areas which are market definition, market segmentation, competitive analysis and research methodology.

To have finest market insights and knowhow of the most excellent market opportunities into the specific markets, Europe Treasury Software Market research report is an ideal option. The report carries out the study of the market with respect to general market conditions, market status, market improvement, key developments, cost and profit of the specified market regions, position and comparative pricing between major players. Each topic of this report is examined very wisely to acquire a clear idea about all the factors that are influencing the market growth and Europe Treasury Software Market industry. The research study that has taken place in the large-scale Europe Treasury Software Market report covers the local, regional as well as global market.

Tap into future trends and opportunities shaping the Europe Treasury Software Market. Download the complete report:

https://www.databridgemarketresearch.com/reports/europe-treasury-software-market

Europe Treasury Software Market Environment

Segments

- On the basis of component, the Europe treasury software market can be segmented into software and services. Software solutions are designed to streamline treasury operations, automate processes, and provide real-time insights. On the other hand, services segment includes implementation, support, and consulting services offered by vendors to ensure the smooth functioning of the software.

- When it comes to deployment type, the market can be categorized into cloud-based and on-premises. Cloud-based treasury software solutions provide scalability, flexibility, and cost-effectiveness, making them increasingly popular among organizations. On-premises solutions, although traditional, are still preferred by some companies due to security concerns and specific requirements.

- Based on organization size, the Europe treasury software market can be divided into small and medium-sized enterprises (SMEs) and large enterprises. SMEs are adopting treasury software to enhance their cash management, risk management, and compliance functions, while large enterprises are investing in advanced solutions to manage complex treasury operations efficiently.

Market Players

- Kyriba Corporation: Kyriba offers a comprehensive treasury management suite that includes cash management, risk management, payments, and financial planning capabilities. The company caters to a wide range of industries and is known for its innovative solutions and customer-centric approach.

- FIS: FIS provides a suite of treasury and risk management solutions that help organizations optimize liquidity, manage financial risks, and automate treasury processes. The company's expertise in financial technology and global presence make it a prominent player in the Europe treasury software market.

- GTreasury (ION): GTreasury, now part of ION Group, offers a cloud-based treasury management system that enables organizations to centralize cash, manage risk, and streamline treasury operations. The platform is known for its user-friendly interface and advanced features that cater to the evolving needs of modern treasurers.

- SAP SE: SAP's treasury management solutions empower organizations to automate cash flows, mitigate financial risks, and comply with regulations. The company's robust platform integrates seamlessly with other SAP modules, providing a holistic view of the organization's financial landscape.

- TreasuryXpress: TreasuryXpress offers a suite of on-demand treasury management solutions designed for ease of use and rapid deployment. The company's focus on innovation and customer satisfaction has made it a preferred choice for organizations looking to enhance their treasury functions in a cost-effective manner.

The Europe treasury software market is witnessing a gradual shift towards more advanced and user-friendly solutions to meet the evolving needs of organizations across various industries. One of the emerging trends in the market is the increasing demand for integrated treasury management suites that offer a wide range of functionalities such as cash management, risk management, payments, and financial planning. This trend is driven by the growing need for organizations to streamline their treasury operations, enhance decision-making processes, and improve overall financial performance.

Another significant trend in the Europe treasury software market is the rise of cloud-based solutions as a preferred deployment option for many organizations. Cloud-based treasury software offers several advantages, including scalability, flexibility, and cost-effectiveness, making it an attractive option for organizations of all sizes. With the increasing focus on remote work and digital transformation, cloud-based treasury solutions are becoming increasingly popular as they enable organizations to access critical treasury functionalities from anywhere at any time.

Moreover, the market is witnessing a growing emphasis on compliance and risk management functionalities within treasury software solutions. With regulatory requirements becoming more stringent and financial risks becoming more complex, organizations are looking for treasury software that not only streamlines their operations but also helps them ensure compliance with regulations and manage risks effectively. This trend is driving vendors to enhance their offerings with advanced risk management capabilities and compliance features to meet the changing needs of their customers.

Furthermore, the Europe treasury software market is witnessing increased competition among market players, leading to a greater focus on innovation and customer-centric approaches. Vendors are investing in research and development to introduce cutting-edge features and functionalities that cater to the specific requirements of different industries and organizations. Additionally, customer satisfaction and user experience are becoming key differentiators in the market, with vendors striving to provide intuitive interfaces, seamless integrations, and personalized support services to enhance the overall user experience.

Overall, the Europe treasury software market is expected to continue its growth trajectory driven by factors such as digital transformation, regulatory compliance requirements, and the increasing focus on financial risk management. Market players are likely to focus on expanding their product portfolios, improving customer engagement strategies, and enhancing their technological capabilities to stay competitive in the dynamic landscape of the treasury software market.The Europe treasury software market is experiencing a significant transformation with the gradual adoption of more advanced and user-friendly solutions to cater to the evolving needs of organizations across various industries. One noteworthy trend in the market is the increasing demand for integrated treasury management suites that encompass diverse functionalities such as cash management, risk management, payments, and financial planning. This trend is driven by organizations' increasing need to streamline their treasury operations, enhance decision-making processes, and boost overall financial performance.

An important development in the Europe treasury software market is the growing popularity of cloud-based solutions as the preferred deployment option for many organizations. Cloud-based treasury software offers benefits such as scalability, flexibility, and cost-effectiveness, making it an appealing choice for organizations of all sizes. With the rising emphasis on remote work and digital transformation, cloud-based treasury solutions are gaining prominence as they enable access to crucial treasury functionalities from any location at any time.

Furthermore, there is a notable focus on compliance and risk management functionalities within treasury software solutions in the Europe market. Organizations are increasingly seeking treasury software that not only streamlines operations but also assists in ensuring compliance with regulations and effectively managing financial risks. This trend is compelling vendors to enhance their offerings with advanced risk management capabilities and compliance features to meet the changing requirements of customers.

Additionally, the Europe treasury software market is witnessing heightened competition among market players, leading to an increased emphasis on innovation and customer-centric approaches. Vendors are investing in research and development to introduce cutting-edge features and functionalities that cater to specific industry and organizational needs. Moreover, customer satisfaction and user experience are emerging as crucial differentiators, prompting vendors to focus on providing intuitive interfaces, seamless integrations, and personalized support services to enhance the overall user experience and differentiate themselves in the market.

Looking ahead, the Europe treasury software market is poised for continued growth, driven by factors such as digital transformation initiatives, rigorous regulatory compliance mandates, and the escalating focus on financial risk management. Market players are expected to concentrate on expanding their product portfolios, refining customer engagement strategies, and enhancing their technological capabilities to remain competitive in the dynamic landscape of the treasury software market.

Evaluate the company’s influence on the market

https://www.databridgemarketresearch.com/reports/europe-treasury-software-market/companies

Forecast, Segmentation & Competitive Analysis Questions for Europe Treasury Software Market

- What is the estimated revenue size for the Europe Treasury Software Market?

- How fast is the Europe Treasury Software Market evolving?

- What are the emerging segments in this market?

- Who are the global influencers in the Europe Treasury Software Market?

- What are the breakthroughs in product development?

- What is the regional diversity in the Europe Treasury Software Market study?

- Which region is most attractive for new entrants?

- What countries are posting consistent growth?

- What markets are nearing saturation?

- What consumer behaviors are shaping future trends?

Browse More Reports:

North America Polyvinyl Chloride (PVC) Compound Market

Asia-Pacific Pharmaceutical Vials Market

Europe Pharmaceutical Vials Market

Middle East and Africa Pharmaceutical Vials Market

North America Pharmaceutical Vials Market

Asia-Pacific Personal Watercraft Market

North America Personal Watercraft Market

Asia-Pacific Passenger Information System Market

Middle East and Africa Passenger Information System Market

North America Passenger Information System Market

China Palmoplantar Pustulosis (PPP) Market

Europe Palmoplantar Pustulosis (PPP) Market

Japan Palmoplantar Pustulosis (PPP) Market

Asia-Pacific Ovarian Cancer Diagnostics Market

Europe Ovarian Cancer Diagnostics Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- الألعاب

- Gardening

- Health

- الرئيسية

- Literature

- Music

- Networking

- أخرى

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness