-

Новости

- ИССЛЕДОВАТЬ

-

Страницы

-

Статьи пользователей

-

Courses

-

Кинозал

Payment Processor Market Size, Share, Trends, Growth & Forecast Explained

"Future of Executive Summary Payment Processor Market Market: Size and Share Dynamics

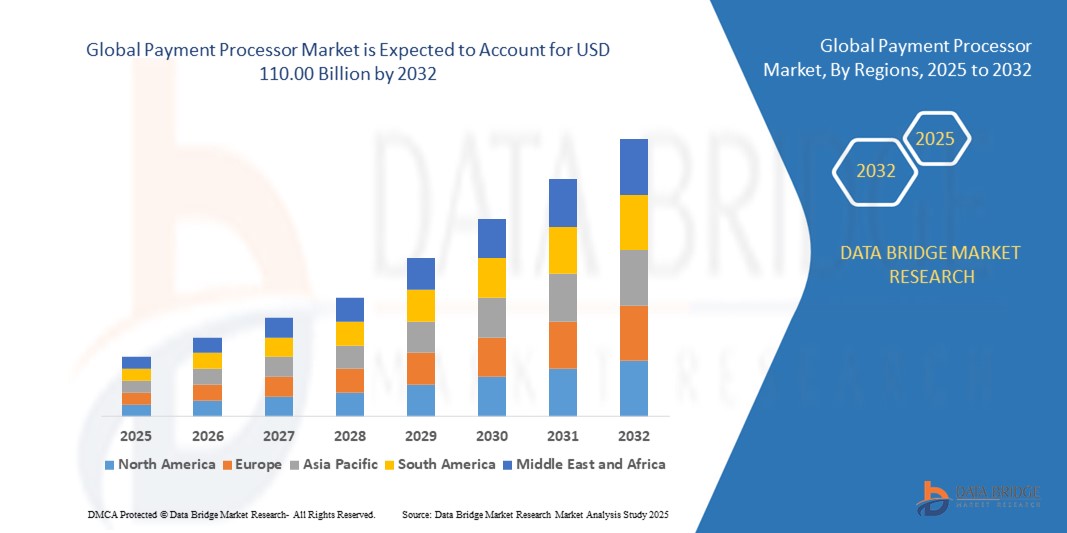

The global payment processor market size was valued at USD 54.32 billion in 2024 and is expected to reach USD 110.00 billion by 2032, at a CAGR of 9.22% during the forecast period.

Payment Processor Market Market research report is a sure solution to get market insights with which business can visualize market place clearly and thereby take important decisions for growth of the business. By getting an inspiration from the marketing strategies of rivals, businesses can set up inventive ideas and striking sales targets which in turn make them achieve competitive advantage over its competitors. Payment Processor Market Market report inspects the market with respect to general market conditions, market improvement, market scenarios, development, cost and profit of the specified market regions, position and comparative pricing between major players.

An influential Payment Processor Market Market report conducts study of market drivers, market restraints, opportunities and challenges underneath market overview which provides valuable insights to businesses for taking right moves. This market report is a source of information about Payment Processor Market Market industry which puts forth current and upcoming technical and financial details of the industry to 2029. The report is a window to the Payment Processor Market Market industry which defines properly what market definition, classifications, applications, engagements and market trends are. Moreover, market restraints, brand positioning, and customer behavior, is also studied with which achieving a success in the competitive marketplace is simplified.

Tap into future trends and opportunities shaping the Payment Processor Market Market. Download the complete report:

https://www.databridgemarketresearch.com/reports/global-payment-processor-market

Payment Processor Market Market Environment

Segments

- By Payment Method: Credit Card, Debit Card, E-Wallet, Net Banking, Others

- By Deployment Type: On-premises, Cloud

- By Organization Size: Small and Medium-sized Enterprises (SMEs), Large Enterprises

- By End-User: Retail, Healthcare, BFSI, Telecom and IT, Others

- By Geography: North America, Europe, Asia-Pacific, Middle East and Africa, Latin America

The global payment processor market is segmented based on various factors such as payment method, deployment type, organization size, end-user, and geography. The payment method segment includes credit cards, debit cards, e-wallets, net banking, and others. Deployment type segment comprises on-premises and cloud-based solutions. Organization size segment is categorized into small and medium-sized enterprises (SMEs) and large enterprises. The end-user segment covers industries like retail, healthcare, BFSI, telecom and IT, among others. Geographically, the market is divided into North America, Europe, Asia-Pacific, Middle East and Africa, and Latin America.

Market Players

- PayPal Holdings, Inc.

- Adyen

- Stripe

- Square, Inc.

- Wirecard AG

- Global Payments Inc.

- Fiserv, Inc.

- Mastercard

- Visa Inc.

- American Express Company

Key players in the global payment processor market include industry giants such as PayPal Holdings, Inc., Adyen, Stripe, Square, Inc., Wirecard AG, Global Payments Inc., Fiserv, Inc., Mastercard, Visa Inc., and American Express Company. These market players are focusing on technological advancements, strategic partnerships, and mergers and acquisitions to gain a competitive edge in the market. With the increasing adoption of digital payment methods and the growing demand for secure and convenient payment processing solutions, these companies are continuously innovating to meet the evolving needs of businesses and consumers in the global marketplace.

The global payment processor market is witnessing significant growth and transformation driven by technological advancements, changing consumer preferences, and increasing digitalization across industries. As businesses and consumers shift towards cashless transactions, the demand for efficient and secure payment processing solutions continues to rise. Payment processors play a crucial role in facilitating transactions between merchants and financial institutions, ensuring seamless and reliable payment processing services. The market players are actively investing in research and development initiatives to enhance their product offerings and stay ahead in the competitive landscape.

One of the key trends shaping the payment processor market is the increasing adoption of mobile payment solutions. With the proliferation of smartphones and the rise of mobile commerce, consumers are increasingly turning to mobile payment apps and e-wallets for convenience and speed. This trend is driving payment processors to develop innovative mobile payment solutions that provide seamless integration with various payment methods and enhance the overall customer experience. Moreover, the integration of technologies such as NFC, biometrics, and AI in mobile payment solutions is further fueling market growth and expanding the capabilities of payment processors.

Another noteworthy trend in the market is the emphasis on data security and compliance. With the rising concerns over data breaches and cyber threats, businesses and consumers are prioritizing secure payment processing solutions that safeguard their sensitive information. Payment processors are investing in robust security measures such as encryption, tokenization, and fraud detection technologies to protect transactions and ensure regulatory compliance. Additionally, the implementation of stringent data security standards such as PCI DSS is driving the adoption of secure payment processing solutions across industries.

Furthermore, the evolving regulatory landscape and changing consumer behavior are influencing the market dynamics of payment processors. Regulatory bodies are imposing stringent regulations regarding data protection, privacy, and anti-money laundering practices, compelling payment processors to adhere to compliance standards and ensure transparency in their operations. Additionally, consumers are seeking seamless payment experiences, personalized services, and value-added features from payment processors, prompting market players to innovate and diversify their service offerings.

In conclusion, the global payment processor market is experiencing significant growth driven by technological innovation, shifting consumer preferences, and regulatory developments. Market players are focusing on enhancing their product portfolios, strengthening security measures, and establishing strategic partnerships to capitalize on emerging opportunities in the digital payment landscape. As the market continues to evolve, businesses and consumers can expect a plethora of advancements and solutions that redefine the way payments are processed and transactions are conducted in the digital era.The global payment processor market is a dynamic and rapidly evolving sector characterized by intense competition, technological innovation, and changing consumer preferences. Market players are continuously investing in research and development efforts to stay ahead of the curve and meet the increasing demand for efficient, secure, and convenient payment processing solutions. With the rise of digitalization and the transition towards cashless transactions, payment processors are playing a pivotal role in facilitating seamless transactions between merchants and financial institutions across various industries.

One of the key drivers shaping the market is the escalating adoption of mobile payment solutions. The proliferation of smartphones and the growing popularity of mobile commerce have propelled the demand for mobile payment apps and e-wallets. As consumers seek convenience and flexibility in their payment options, payment processors are focusing on developing user-friendly and innovative mobile payment solutions that cater to the evolving needs of tech-savvy consumers. The integration of technologies such as NFC, biometrics, and artificial intelligence is further enhancing the capabilities of mobile payment solutions, driving market growth and expanding the reach of payment processors.

Moreover, data security and compliance have emerged as critical priorities for both businesses and consumers in the payment processor market. With the increasing frequency of data breaches and cyber threats, stakeholders are placing a significant emphasis on robust security measures to protect sensitive information and ensure regulatory compliance. Payment processors are investing in advanced encryption, tokenization, and fraud detection technologies to mitigate security risks and enhance transaction security. Compliance with industry standards such as PCI DSS is becoming increasingly imperative, driving the adoption of secure payment processing solutions that instill trust and confidence among users.

The regulatory landscape and evolving consumer behavior are also influencing the market dynamics of payment processors. Regulatory bodies are imposing stringent guidelines related to data protection, privacy, and anti-money laundering practices, compelling market players to adhere to regulatory standards and demonstrate transparency in their operations. Additionally, consumers are seeking personalized payment experiences, seamless services, and added value from payment processors, prompting companies to innovate and diversify their service offerings to meet changing customer expectations and preferences.

In conclusion, the global payment processor market is poised for continued growth and evolution, fueled by technological advancements, changing consumer behavior, and regulatory developments. Market players are leveraging innovation, strategic partnerships, and enhanced security measures to capitalize on emerging opportunities and address the evolving needs of businesses and consumers in the digital payment landscape. As the market landscape continues to evolve, stakeholders can expect a wave of innovation and transformation that will reshape the way payments are processed and transactions are conducted in the digital age.

Evaluate the company’s influence on the market

https://www.databridgemarketresearch.com/reports/global-payment-processor-market/companies

Forecast, Segmentation & Competitive Analysis Questions for Payment Processor Market Market

- How large is the Payment Processor Market Market currently?

- At what CAGR is the Payment Processor Market Market projected to grow?

- What key segments are analyzed in the Payment Processor Market Market report?

- Who are the top companies operating in the Payment Processor Market Market?

- What notable products have been introduced recently in the Payment Processor Market Market?

- What geographical data is included in the Payment Processor Market Market analysis?

- Which region is experiencing the quickest growth in the Payment Processor Market Market?

- Which country is forecasted to lead the Payment Processor Market Market?

- What region currently holds the biggest share of the Payment Processor Market Market?

- Which country is likely to show the highest growth rate in coming years?

Browse More Reports:

Global Payment Gateway Market

Global Semiconductor Manufacturing Equipment Market

Global Smart Home Market

Global Water Treatment Chemicals Market

Global Yacht Charter Market

India Compound Chocolate Market

India Health and Wellness Food Market

India Rare Earth Magnet Market

Indonesia Goat Milk Market

Indonesia Halal Market

Middle East and Africa Cosmetics Market

Saudi Arabia Fleet Management Market

Global Sulfuric Acid Market

Thailand Information Technology (IT) Services Market

Vietnam Elderly Care Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Игры

- Gardening

- Health

- Главная

- Literature

- Music

- Networking

- Другое

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness