Digital Insurance Platform Market Accelerates as InsurTech Innovations Reshape the Insurance Landscape

"Executive Summary Digital Insurance Platform Market Market Trends: Share, Size, and Future Forecast

CAGR Value

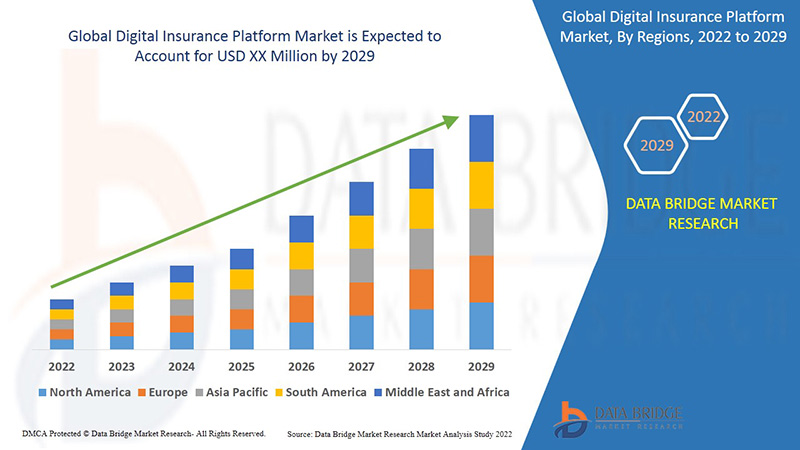

Data Bridge Market Research analyses that the digital insurance platform market will exhibit a CAGR of 13.7% for the forecast period of 2022-2029.

Keeping into consideration the customer requirement, Digital Insurance Platform Market Market research report has been constructed with the professional and comprehensive study. This reliable report comprises of explicit and up to date information about the consumer’s demands, their likings, and their variable preferences about particular product. Market research reports are acquiring huge importance in this speedily transforming market place; hence this market report has been endowed in a way that is anticipated. The world class market report displays several parameters related to Digital Insurance Platform Market Market industry which are systematically studied by the experts. An influential Digital Insurance Platform Market Market report is most suitable for business requirements in many ways.

Digital Insurance Platform Market Market research report is a valuable source of information with which businesses can gain a telescopic view of the current market trends, consumer’s demands and preferences, market situations, opportunities and market status. This market report highlights key market dynamics of sector and encompasses historic data, present market trends, environment, technological innovation, upcoming technologies and the technical progress in the related industry. A lot of hard work has been involved while generating this market research report where no stone is left unturned. Thus, the comprehensive Digital Insurance Platform Market Market report provides a comprehensive analysis on the study of Digital Insurance Platform Market Market industry with respect to a number of aspects.

Examine detailed statistics, forecasts, and expert analysis in our Digital Insurance Platform Market Market report. Download now:

https://www.databridgemarketresearch.com/reports/global-digital-insurance-platform-market

Digital Insurance Platform Market Sector Overview

Segments

- Component: The digital insurance platform market can be segmented based on components into tools and services. Tools segment can further be categorized into data management & analytics, digital engagement, policy administration, claim management, and others. Services segment can include professional services and managed services.

- Deployment Type: On the basis of deployment type, the market can be divided into on-premises and cloud. The cloud segment is expected to witness significant growth due to benefits such as scalability, cost-effectiveness, and ease of access.

- Insurance Type: Segmentation by insurance type can include property and casualty insurance, health insurance, life insurance, and others. The property and casualty insurance segment is anticipated to dominate the market share due to the increasing adoption of digital platforms by insurers to enhance customer experience and streamline operations.

- Organization Size: The digital insurance platform market can also be segmented based on organization size into large enterprises and small & medium-sized enterprises (SMEs). Large enterprises segment is expected to hold a major market share as they are early adopters of digital solutions and have the resources to invest in advanced technologies.

Market Players

- IBM Corporation: IBM provides digital insurance platform solutions that leverage AI, analytics, and cloud technologies to help insurers modernize their operations and improve customer engagement.

- Oracle Corporation: Oracle offers a comprehensive digital insurance platform that enables insurers to launch new products quickly, improve underwriting accuracy, and enhance customer service through digital channels.

- SAP SE: SAP's digital insurance platform helps insurers simplify policy administration, streamline claims processing, and personalize customer interactions using advanced analytics and machine learning capabilities.

- Microsoft Corporation: Microsoft's digital insurance solutions focus on enabling insurers to optimize business processes, enhance risk management, and deliver personalized experiences to policyholders through AI-driven insights.

- Accenture: Accenture provides digital insurance platform services that help insurers innovate their business models, optimize core operations, and accelerate digital transformation through agile methodologies and cutting-edge technologies.

The global digital insurance platform market is highly competitive with the presence of key players offering advanced solutions to meet the evolving needs of insurers and policyholders. The market is driven by the increasing adoption of digital technologies in the insurance sector, rising demand for personalized insurance products, and the growing emphasis on enhancing operational efficiency and customer experience. Factors such as regulatory compliance requirements, data security concerns, and legacy system integration challenges may hinder market growth to some extent. However, ongoing technological advancements, increasing investments in InsurTech startups, and the expanding InsurTech ecosystem are likely to create lucrative opportunities for market players in the coming years.

The digital insurance platform market is witnessing a significant transformation driven by the rapid advancements in digital technologies and the increasing demand for personalized insurance solutions. One key trend shaping the market is the integration of artificial intelligence (AI), machine learning, and data analytics into insurance platforms to enhance operational efficiency, risk assessment, and customer engagement. Market players are focusing on developing innovative tools and services that cater to the evolving needs of insurers and policyholders, such as automated underwriting processes, real-time claims processing, and personalized policy recommendations.

Moreover, the rising adoption of cloud-based deployment models is enabling insurers to leverage scalable and cost-effective digital platforms that offer flexibility and accessibility from anywhere. Cloud-based solutions also facilitate seamless integration with other systems and applications, promoting interoperability and data sharing across the insurance ecosystem. As a result, insurers are able to deliver a more seamless customer experience, drive operational agility, and improve decision-making based on real-time data insights.

In terms of insurance type segmentation, the property and casualty insurance segment is witnessing high growth as insurers look to digitize their operations to better assess risks, streamline claims handling, and improve customer satisfaction. The adoption of digital platforms in this segment is driven by the need to offer competitive insurance products, reduce underwriting and claims processing time, and enhance fraud detection capabilities through advanced analytics and predictive modeling.

Furthermore, the market landscape is characterized by intense competition among key players such as IBM Corporation, Oracle Corporation, SAP SE, Microsoft Corporation, and Accenture. These companies are investing heavily in R&D to develop cutting-edge digital insurance solutions that meet the diverse needs of insurers and policyholders in a rapidly evolving market environment. Collaborations, partnerships, and acquisitions are becoming common strategies for market players to expand their product offerings, enhance technological capabilities, and gain a competitive edge in the digital insurance platform market.

Overall, the digital insurance platform market is poised for significant growth fueled by the continued digitalization of the insurance industry, increasing customer expectations for personalized experiences, and the drive towards operational excellence. Despite challenges related to regulatory compliance, data security, and legacy system integration, the market presents opportunities for innovation, expansion, and differentiation for players that can leverage technology to drive digital transformation in the insurance sector.The digital insurance platform market is undergoing a rapid transformation driven by technological advancements and the changing preferences of insurers and policyholders. One key trend that is shaping the market is the integration of artificial intelligence (AI), machine learning, and data analytics into insurance platforms. These technologies are being used to improve operational efficiency, enhance risk assessment processes, and foster better customer engagement. By leveraging AI and machine learning algorithms, insurers can automate underwriting procedures, expedite claims processing, and offer personalized policy recommendations to policyholders, thereby streamlining operations and enhancing overall customer satisfaction.

Additionally, the increasing adoption of cloud-based deployment models is revolutionizing the way insurers access and utilize digital insurance platforms. Cloud solutions provide scalability, cost-effectiveness, and accessibility from any location, enabling insurers to seamlessly integrate their systems and applications. This integration promotes interoperability and data sharing within the insurance ecosystem, empowering insurers to deliver a more cohesive customer experience, enhance operational agility, and make data-driven decisions based on real-time insights.

Within the insurance type segmentation, the property and casualty insurance segment is experiencing significant growth as insurers shift towards digital platforms to enhance risk assessment, streamline claims handling, and improve customer service. The adoption of digital solutions in this segment is being primarily driven by the need to remain competitive, reduce processing times, and bolster fraud detection capabilities through advanced analytics and predictive modeling techniques. Insurers are increasingly investing in digital platforms to offer more tailored insurance products, improve operational efficiency, and enhance overall customer satisfaction.

Moreover, the market landscape is fiercely competitive, with key players such as IBM Corporation, Oracle Corporation, SAP SE, Microsoft Corporation, and Accenture leading the way in offering innovative digital insurance solutions. These market players are heavily investing in research and development to create cutting-edge platforms that cater to the evolving needs of insurers and policyholders in a rapidly changing market environment. Collaborations, partnerships, and acquisitions are becoming common strategies for these players to expand their product portfolios, enhance technological capabilities, and gain a competitive advantage in the digital insurance platform market.

In conclusion, the digital insurance platform market is poised for substantial growth driven by digitalization trends in the insurance industry, rising customer expectations for personalized services, and a focus on operational excellence. Despite challenges related to regulatory compliance, data security, and integration issues, the market offers ample opportunities for innovation, expansion, and differentiation for companies that can leverage technology effectively to drive digital transformation in the insurance sector.

View company-specific share within the sector

https://www.databridgemarketresearch.com/reports/global-digital-insurance-platform-market/companies

Strategic Question Sets for In-Depth Digital Insurance Platform Market Market Analysis

- What is the present valuation of the Digital Insurance Platform Market Market?

- What is the future growth outlook for the Digital Insurance Platform Market Market?

- Which are the core market segments detailed in the report?

- Who dominates the competitive landscape of the Digital Insurance Platform Market Market?

- What are the most recent innovations by players in the Digital Insurance Platform Market Market?

- Which countries are part of the market coverage in the report?

- Which region is gaining traction rapidly in the Digital Insurance Platform Market Market?

- Which country is poised to lead in terms of market dominance?

- What area controls the majority share in the Digital Insurance Platform Market Market?

- Which country is anticipated to see the fastest growth rate?

Browse More Reports:

Global Epstein-Barr Virus Drug Market

Global Essential Oils and Plant Extracts for Livestock Market

Global E-Tailing Solutions Market

Global E-Transit Metro Ethernet Services Market

Global Evans Syndrome Market

Global EV Charging Panelboard Market

Global Expandable Microspheres Market

Global Extended Reality Market

Global Extended Text Labels Market

Global Failure Analysis Market

Global Fat Replacers Market

Global Feed Flavor and Sweetener Ingredients Market

Global Feed Pigments Market

Global fiberglass pipes Market

Global Fire Resistant Hydraulic Fluids Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness