-

Feed de Notícias

- EXPLORAR

-

Páginas

-

Blogs

-

Courses

-

Movies

The Quiet Market Shift Few Investors Noticed

On a quiet Monday morning, just before the opening bell, Ethan stared at his brokerage app. For years, he had invested in individual tech stocks—some soared, some collapsed overnight. But on this particular morning, a chart caught his eye. It wasn’t a flashy startup or a hyped AI company. It was an ETF chart. Smooth, steady, rising. That was the moment he heard it for the first time: vanguard information technology etf price.

It wasn’t dramatic. No media buzz. Yet, it represented something powerful—a consolidated bet on the very tech innovation that had defined the past two decades. Ethan didn’t know it yet, but that one glance would change how he viewed investing forever.

What Makes This ETF Stand Out?

The Vanguard Information Technology ETF (VGT) tracks some of the most influential technology companies listed in the U.S. Unlike buying a single stock, this ETF gives exposure to dozens of companies at once—spreading risk and strengthening long-term potential.

This fund includes companies at the heart of tech: semiconductor giants, cloud providers, digital payment innovators, and software leaders. By blending established leaders with disruptive challengers, it creates balanced exposure to the sector driving global economic transformation.

Understanding Its Market Performance Trends

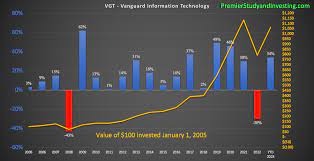

Technology has been one of the strongest performing sectors for more than a decade. Even in market downturns, tech frequently leads market recovery. That resilience is reflected in the fund’s historical return patterns.

- Higher long-term returns than broader indexes

- Frequent rebalancing to include rising tech leaders

- A cost structure significantly lower than industry averages

Investors benefit not just from past performance but from the ongoing structural shift toward digital systems, automation, and scalable AI.

Key Factors That Influence Price Behavior

Technology Earnings and Valuation Cycles

The ETF’s pricing is strongly connected to earnings performance of its top holdings. When companies like Apple, Microsoft, and Nvidia outperform, the ETF rises as a whole.

Macroeconomic Trends and Interest Rates

Tech valuations are interest-rate sensitive. Lower rates generally lift growth stocks, increasing demand for innovation-based funds.

Investor Sentiment on Innovation

Whenever new breakthroughs make headlines—AI, quantum computing, cybersecurity—the technology sector sees inflows of capital, which supports price growth.

Comparing It to Other Technology Funds

Many investors wonder why this specific ETF stands out from alternatives like QQQ or XLK. The biggest differentiators are:

- Lower expense ratio than most competitors

- Broader diversification across tech sub-industries

- A long-term, stability-focused construction rather than aggressive weighting

This allows it to capture sector-wide gains without relying on a single mega-cap to carry performance.

Who Should Consider Investing in This ETF?

Long-Term Growth Investors

Those seeking compound growth without frequent trading may find this ETF ideal.

Risk-Aware Tech Believers

If you believe technology will continue reshaping industries—but don’t want to guess which stock will win—this ETF provides diversified exposure.

Retirement-Focused Investors

Its combination of growth potential and relative stability fits well into retirement accounts where steady appreciation matters more than speculative swings.

Why the Story Matters for Investors Today

Ethan’s discovery is not just fiction—it mirrors a real trend. Thousands of investors have shifted from stock-picking to thematic ETFs that pull risk away from single-company failures. The technology sector is evolving so quickly that diversification has become a necessity, not just a strategy.

Even major institutions now use targeted ETFs to maintain exposure without constant rebalancing. The rise of automated investing platforms further strengthens demand for structured, broad-based tech funds.

Strategic Timing and Market Entry Considerations

Even the best long-term investment can be bought at a bad time. Investors frequently monitor:

- Price-to-earnings ratios of underlying holdings

- Market corrections to buy at discounted levels

- The relationship between tech earnings cycles and macroeconomic slowdowns

That is why some investors watch the vanguard information technology etf price over time, waiting patiently for dips rather than rushing at peak valuations.

Final Thoughts and Long-Term Outlook

Technology is not slowing down. From artificial intelligence to cloud automation, innovation continues fueling market expansion. The ETF at the center of Ethan’s story has become a quiet gateway into that revolution.

By understanding historical strength, cost advantages, diversified holdings, and its performance drivers, investors can position themselves strategically rather than making emotional decisions.

In a world where markets shift overnight and single stocks rise and fall unpredictably, monitored carefully, the vanguard information technology etf price represents something rare—a disciplined, balanced approach to investing in the future.

Conclusion

The journey that began with curiosity for Ethan is now a lesson for countless investors. Technology may be volatile, but structured, diversified exposure gives individuals a smart entry point without taking on unnecessary risk. Whether watching the vanguard information technology etf price daily or buying it for long-term growth, investors gain access to the sector driving modern innovation. In the end, the question is not whether technology will shape the future—it’s whether you’ll be positioned to benefit from it.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness