-

Ροή Δημοσιεύσεων

- ΑΝΑΚΆΛΥΨΕ

-

Σελίδες

-

Blogs

-

Courses

-

Ταινίες

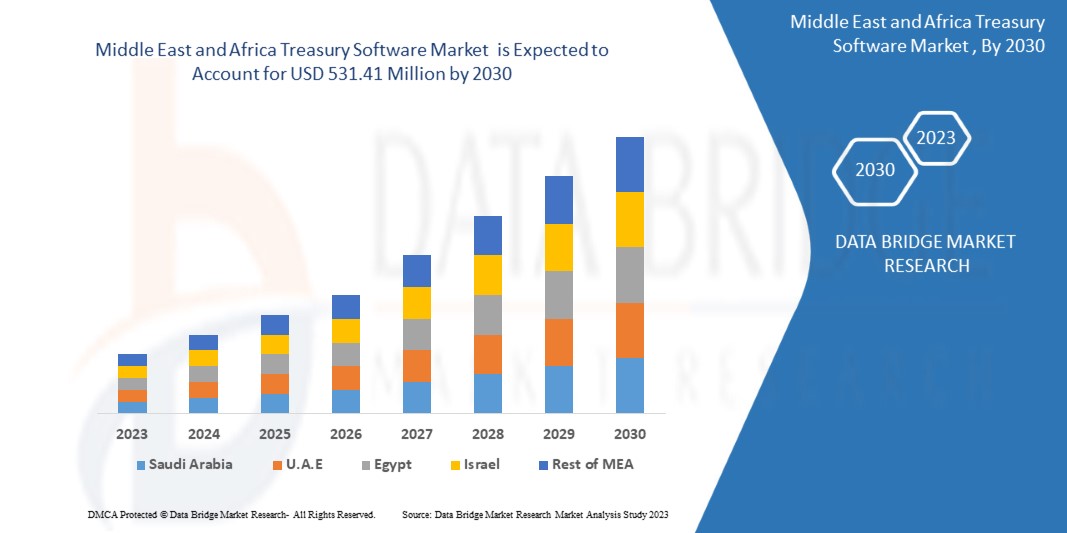

Middle East and Africa Treasury Software Market Growth Trends, Size, Share and Outlook to 2030

"Executive Summary Middle East and Africa Treasury Software Market Opportunities by Size and Share

Data Bridge Market Research analyses that the market is growing with the CAGR of 2.5% in the forecast period of 2023 to 2030 and expected to reach USD 531.41 million by 2030.

Middle East and Africa Treasury Software Market research report is a verified and consistent source of information that puts forth a telescopic view of the existing market trends, emerging products, situations and opportunities. This information holds an immense significance to drive business towards the success. The industry report comprises of explicit and up to date information about the consumer’s demands, their likings, and their variable preferences about particular product. Middle East and Africa Treasury Software Market report all-inclusively guesstimates general market conditions, the growth scenario in the market, likely restrictions, major industry trends, market size, market share, sales volume and future trends.

Extremely talented minds have put in their lot of time for doing market research analysis and structure an all inclusive Middle East and Africa Treasury Software Market Furthermore, the report gives insights into revenue growth and sustainability initiative. This global market report includes all the company profiles of the major players and brands. This report endows clients with the information on their business scenario which aids to stay ahead of competition in today's swiftly revolutionizing business environment. The Middle East and Africa Treasury Software Market industry is anticipated to witness growth during the forecast period due to growing demand at the end user level.

Analyze top trends and market forces impacting the Middle East and Africa Treasury Software Market. Full report ready for download:

https://www.databridgemarketresearch.com/reports/middle-east-and-africa-treasury-software-market

Current Scenario of the Middle East and Africa Treasury Software Market

Segments

- Based on deployment type, the Middle East and Africa treasury software market can be segmented into cloud-based and on-premises solutions. The cloud-based segment is expected to witness significant growth due to its scalability, cost-effectiveness, and ease of deployment. Organizations are increasingly adopting cloud-based treasury software to streamline their financial operations and increase efficiency.

- On the basis of organization size, the market can be categorized into small and medium-sized enterprises (SMEs) and large enterprises. SMEs are expected to show substantial growth in the adoption of treasury software to better manage their financial resources and improve cash flow management. Large enterprises, on the other hand, are investing in advanced treasury solutions to handle complex financial operations and mitigate risks.

- By application, the market can be classified into cash and liquidity management, risk management, payment processing, compliance and regulatory reporting, and others. Cash and liquidity management is anticipated to dominate the market as organizations focus on optimizing their cash positions and enhancing liquidity management to support business growth and expansion.

Market Players

- Some of the key players operating in the Middle East and Africa treasury software market include Kyriba Corp, GTreasury, FIS, SAP SE, Oracle, ION Group, Reval, Taulia, Finastra, and TreasuryXpress. These market players are focusing on product innovations, strategic partnerships, and mergers and acquisitions to enhance their market presence and gain a competitive edge. With the increasing demand for advanced treasury solutions in the region, these players are expanding their product portfolios to cater to the diverse needs of organizations across various industries.

For more insights, visit The Middle East and Africa treasury software market is poised for significant growth in the coming years due to various factors shaping the landscape. One key trend that is expected to drive market expansion is the increasing digitization of financial services in the region. As organizations in the Middle East and Africa look to modernize their treasury operations, there is a growing demand for advanced software solutions that can help streamline financial processes, enhance decision-making, and improve overall efficiency. This trend is particularly evident in the shift towards cloud-based treasury software, which offers scalability, cost-effectiveness, and ease of deployment, making it an attractive option for organizations looking to enhance their financial capabilities.

In addition to the deployment type, the segmentation based on organization size is also playing a crucial role in shaping the market dynamics. Small and medium-sized enterprises (SMEs) are increasingly recognizing the value of treasury software in better managing their financial resources and optimizing cash flow management. As a result, the adoption of treasury solutions among SMEs is expected to witness substantial growth in the forecast period. On the other hand, large enterprises are focusing on advanced treasury solutions to address complex financial operations and mitigate risks, driving the demand for sophisticated software offerings in the market.

When it comes to applications, cash and liquidity management emerge as a dominant segment within the Middle East and Africa treasury software market. Organizations across various industries are prioritizing cash optimization and liquidity management to support business growth and operational expansion. By effectively managing cash positions and liquidity, businesses can improve their financial health, enhance working capital management, and drive sustainable growth in the long run.

Key players in the Middle East and Africa treasury software market, such as Kyriba Corp, GTreasury, SAP SE, and Oracle, are actively investing in product innovations and strategic partnerships to strengthen their market presence and stay ahead of the competition. Mergers and acquisitions are also a common strategy among market players to expand their product portfolios and cater to the diverse needs of organizations across different industries in the region. With the growing demand for advanced treasury solutions and the increasing focus on digital transformation, these market players are well-positioned to capitalize on emerging opportunities and drive further growth in the Middle East and Africa treasury software market.The Middle East and Africa treasury software market is experiencing significant growth driven by multiple factors that are reshaping the industry landscape. One notable trend fueling market expansion is the increasing digitization of financial services in the region. As organizations strive to modernize their treasury operations, there is a rising demand for advanced software solutions that can streamline financial processes, enhance decision-making, and boost overall efficiency. This trend is prominently evident in the shift towards cloud-based treasury software, which offers scalability, cost-effectiveness, and easy deployment, making it an appealing choice for organizations seeking to elevate their financial capabilities and adapt to the digital era.

Furthermore, the segmentation based on organization size is a critical factor shaping the market dynamics. Small and medium-sized enterprises (SMEs) are increasingly acknowledging the value of treasury software in optimizing financial resource management and cash flow operations. Consequently, the adoption of treasury solutions among SMEs is poised for significant growth in the forecast period. On the other hand, large enterprises are gravitating towards advanced treasury solutions to manage complex financial operations and mitigate risks effectively, propelling the demand for sophisticated software offerings within the market.

In terms of applications, cash and liquidity management stand out as a dominant segment within the Middle East and Africa treasury software market. Businesses across diverse industries prioritize cash optimization and liquidity management to bolster business growth and operational expansiveness. By efficiently handling cash positions and liquidity, organizations can bolster their financial well-being, enhance working capital management, and stimulate sustainable growth over time.

Key players in the Middle East and Africa treasury software market, such as Kyriba Corp, GTreasury, SAP SE, and Oracle, are actively engaged in product innovation and strategic partnerships to fortify their market footprint and maintain a competitive edge. Mergers and acquisitions are also prevalent strategies among market participants to diversify their product portfolios and cater to the varying needs of organizations spanning different industries in the region. With the escalating demand for advanced treasury solutions and the escalating focus on digital transformation, these market players are well-positioned to leverage emerging opportunities and propel further growth in the Middle East and Africa treasury software market.

Access segment-wise market share of the company

https://www.databridgemarketresearch.com/reports/middle-east-and-africa-treasury-software-market/companies

Targeted Question Batches for Middle East and Africa Treasury Software Market Exploration

- What is the global financial outlook of the Middle East and Africa Treasury Software Market?

- What growth levels are predicted across Middle East and Africa Treasury Software Market segments?

- What segmentation structure does the Middle East and Africa Treasury Software Market report follow?

- Which companies are the largest by Middle East and Africa Treasury Software Market capitalization?

- What nations are identified as growth drivers for Middle East and Africa Treasury Software Market?

- Who are the fastest-growing competitors in the Middle East and Africa Treasury Software Market?

Browse More Reports:

Global Stretch Blow Molding Machine Market

Global Plant Activators Market

Global Lecithin and Phospholipids Market

Global Circular Liquid Crystal Polymer Connector (LCP) Market

Global Insect Repellent Market

Global Ovarian Cancer Diagnostics Market

Global Plasma Protease C1-inhibitor Market

Global AI-Driven Pathology Tools Market

Global AI-Powered Prosthetics Market

Global Air Runner Market

Global Aliphatic Hydrocarbon Solvents and Thinners Market

Global Aneurysmal Subarachnoid Hemorrhage Market

Global Antimycotic Drugs Market

Global Auriculo-Condylar Syndrome Market

Global Automotive Stabilizer Bar Link Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Παιχνίδια

- Gardening

- Health

- Κεντρική Σελίδα

- Literature

- Music

- Networking

- άλλο

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness