Linear Low-Density Polyethylene Market - Analysis by Market Share

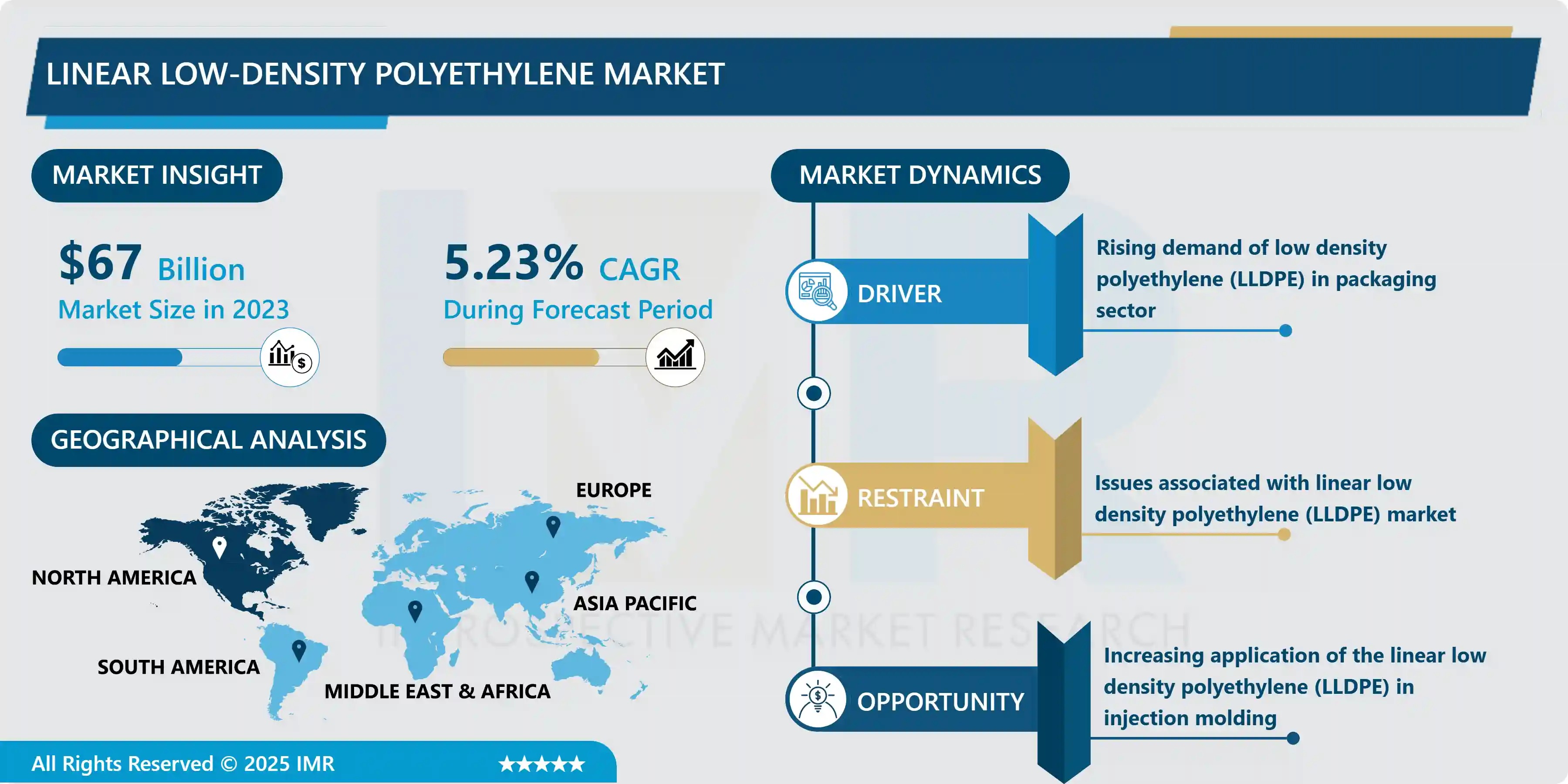

Introspective Market Research, a global leader in chemical and materials analysis, today announced the release of its definitive report on the Global Linear Low-Density Polyethylene (LLDPE) Market. The market, valued at USD 67.00 Billion in 2023, is forecasted to sustain robust expansion, reaching USD 106.01 Billion by 2032. This steady growth reflects a healthy Compound Annual Growth Rate (CAGR) of 5.23% throughout the 2024–2032 forecast period.

The Linear Low-Density Polyethylene Market is a cornerstone of modern industrial and consumer supply chains. Its exceptional properties—including superior tensile strength, high flexibility, and puncture resistance—make it the preferred choice over traditional Low-Density Polyethylene (LDPE) in high-performance applications. The market's consistent growth is overwhelmingly driven by the rising demand in the packaging sector, fueled by the global e-commerce boom, and the critical need for resilient, flexible film solutions across the food, retail, and industrial domains.

Quick Insights: Key Metrics of the LLDPE Market

· Market Valuation (2023): USD 67.00 Billion.

· Projected Market Size (2032): USD 106.01 Billion.

· Steady CAGR: 5.23% (2024–2032).

· Dominant Application Segment: Films (including stretch films, liners, and flexible packaging).

· Largest Regional Market: Asia-Pacific, due to immense manufacturing capacity and escalating regional consumer demand.

· Key Driver: Global expansion of flexible and protective packaging.

· Primary Restraint: Volatility in Ethylene Feedstock Prices and environmental pressures concerning plastic waste.

· Core Opportunity: Integration of high-performance metallocene LLDPE (mLLDPE) and increased recycling efforts.

Global Polymer Consumption: LLDPE Market Revenue Breakdown

The forecasted growth to over $\$100$ Billion underscores LLDPE’s indispensable role in global manufacturing. Despite macroeconomic pressures and commodity price volatility, its performance superiority ensures sustained demand, particularly in developing economies prioritizing infrastructure and consumer packaged goods (CPG) production.

|

Metric |

Base Year (2023) |

Forecast Year (2032) |

CAGR (2024-2032) |

|

Market Value (USD Billion) |

67.00 |

106.01 |

5.23% |

How Are Technology and Sustainability Overcoming Cost and Environmental Pressures?

The LLDPE industry consistently faces cost pressure from two fronts: the fluctuating global price of ethylene, the key raw material derived from crude oil or natural gas; and the high capital cost associated with building advanced polymerization plants (Gas Phase and Solution Phase). Simultaneously, intense environmental concerns related to plastic waste management demand sustainable innovation.

Breakthroughs for Cost-Efficiency and Benefits:

· Technological Breakthroughs & Cost-Efficiency: Manufacturers are leveraging advanced catalyst technology, specifically metallocene catalysts, to produce high-performance LLDPE grades (mLLDPE). This allows end-users to employ the concept of ‘lightweighting’, creating films that are significantly thinner yet maintain superior mechanical strength and puncture resistance. This reduces material usage and lowers the per-unit packaging cost, providing a major cost-efficient benefit.

· Sustainability Benefits: The industry is heavily investing in the integration of Post-Consumer Recycled (PCR) LLDPE materials. Breakthroughs from top companies like Borealis AG and Dow involve launching high-performance recycled LLDPE grades that align with circular economy goals, transforming waste into a valuable resource and mitigating environmental regulatory risks.

Expert Commentary on the Future of Polyethylene:

"The LLDPE market is evolving from a commodity game to a specialty performance arena," states Mr. Arthur Vance, Principal Consultant at Introspective Market Research. "While crude oil volatility presents a constant cost pressure, the strategic focus has shifted to creating 'more with less.' The latest breakthroughs in polymerization process efficiency—particularly the widespread adoption of next-generation metallocene LLDPE—enable converters to produce films that are stronger at lower thicknesses. This 'lightweighting' trend delivers immense benefits: it reduces resin consumption, cuts transportation costs, and, critically, meets the environmental mandate for source reduction. The ability of LLDPE to be highly recyclable further solidifies its position as the polymer of choice for the world’s most demanding flexible packaging applications."

Regional Dynamics and Segmentation Leadership

Regional Analysis:

· Asia-Pacific continues its undisputed dominance, driven by massive infrastructure expansion and rapid urbanization across major economies like China and India. The region's vast and expanding packaging and construction industries provide an unparalleled consumption base for LLDPE films and geomembranes.

· North America and Europe are focused heavily on the premium segment, emphasizing high-performance metallocene grades for specialized films and driving innovation in recycling and bio-based LLDPE alternatives to address sustainability concerns.

Segmentation Deep Dive:

· By Application, the Films segment holds a commanding market share, projected to remain the largest application due to its indispensability in stretch wraps, shrink films, agricultural films (mulch and greenhouse covers), and flexible food packaging.

· By End-Use Industry, Packaging is the largest consumer, but the Construction and Automotive sectors are also seeing notable LLDPE adoption for pipes, insulation, and durable molded components, capitalizing on the material's impact resistance and longevity.

· By Type, the C6-LLDPE and C8-LLDPE types, which are generally associated with higher performance characteristics than C4-LLDPE, are registering significant growth, reflecting the industry's shift toward high-spec applications.

Competitive Landscape: Capacity and Innovation

The LLDPE market is led by global petrochemical giants with vast integrated supply chains, including Dow, Exxon Mobil, SABIC, LyondellBasell, TotalEnergies SE, and Reliance Industries Limited.

Strategic Developments:

· Capacity Expansion: Major players continue to announce new production facility developments, particularly in the Middle East and Asia-Pacific, to capitalize on low-cost feedstocks and regional demand growth, often employing the most energy-efficient Gas Phase or Solution Phase technologies.

· Product Diversification: Companies are broadening their portfolio of specialty grades, such as ultra-low-density polyethylene (ULDPE), derived from the LLDPE process, to capture niche markets requiring extreme flexibility and seal strength, pushing the material’s performance boundaries.

About Introspective Market Research

Introspective Market Research is a leading provider of comprehensive market intelligence, delivering strategic reports and consulting services across diverse industries, including Chemicals & Materials, Packaging, and Automotive. We empower our clients with the critical data needed to anticipate market trends, optimize operations, and achieve their strategic growth objectives in complex global landscapes.

Access the Linear Low-Density Polyethylene Market Intelligence

Gain a competitive edge with a detailed analysis of regional capacities, technology forecasts, and competitive strategies.

[Download Sample Report: Introspective Market Research]

Contact Information:

Introspective Market Research

South King Drive, Chicago, IL

Phone: +91-91753-37569

Email: sales@introspectivemarketresearch.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness