North America Recycled Plastic Market: Navigating Sustainable Growth and Circular Economy

The North America Recycled Plastic Market is poised for substantial growth, driven by a powerful confluence of environmental mandates, corporate sustainability targets, and heightened consumer demand for eco-friendly products.

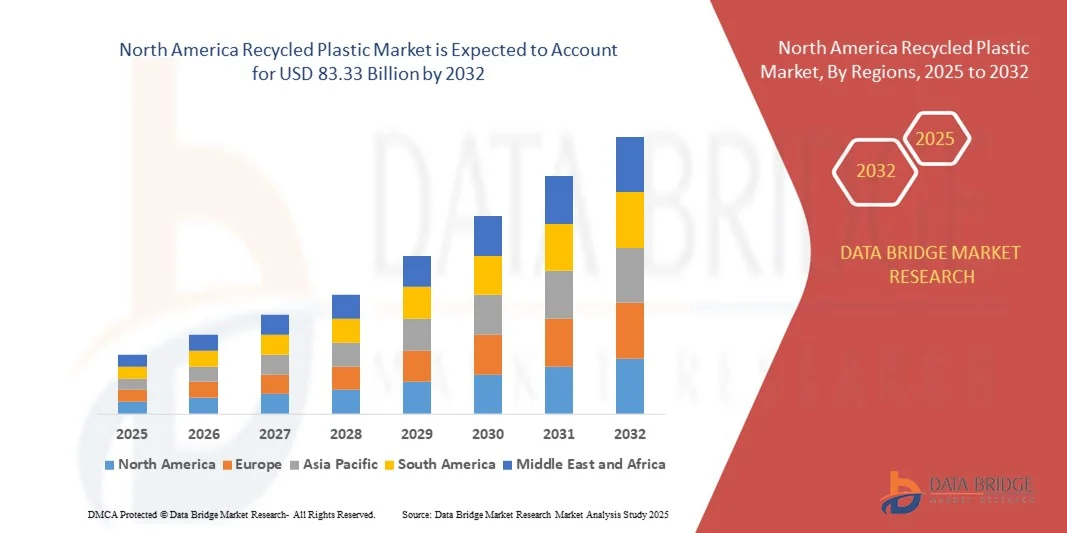

The North America Recycled Plastic Market size was valued at USD 54.30 billion in 2024 and is projected to reach USD 83.33 billion by 2032, growing at a CAGR of 5.50% during the forecast period

As the region pivots aggressively towards a circular economy model, the market for high-quality recycled polymers is witnessing unprecedented demand, especially in the US and Canada.

A robust data-driven outlook projects the North America Recycled Plastic Market valuation to reach approximately USD 16.9 billion by 2030, escalating from a reported USD 9.4 billion in 2023. This strong expansion is forecast to register a notable Compound Annual Growth Rate (CAGR) of 8.7% during the forecast period of 2024 to 2030. Key industry drivers include stringent government regulations, major brand commitments to Post-Consumer Recycled (PCR) content, and technological advancements in both mechanical and chemical recycling. This growth represents a significant market opportunity for recyclers, resin producers, and end-use industries across the region to capitalize on the transition away from virgin plastics.

Market Overview

The recycled plastics market in North America encompasses the collection, sorting, processing, and sale of polymers derived from post-consumer and post-industrial plastic waste. The US dominates the market share due to its large industrial base and high volume of plastic consumption, although Canada is emerging as a high-growth country, expected to register one of the fastest CAGRs in the region. The primary goal is to close the loop on plastic waste, which is increasingly becoming a critical environmental and regulatory concern. The shift to recycled plastic resin not only reduces landfill burden and pollution but also significantly lowers the carbon footprint associated with plastic production.

Market Size & Market Share Analysis

The estimated market size for North America’s recycled plastic industry reflects a strong expansion trajectory, confirming its role as a key pillar of the sustainable packaging and manufacturing sectors.

The current demand analysis shows that Polyethylene Terephthalate (PET) holds the largest market share by resin type. This dominance is primarily attributed to the efficient, well-established collection and recycling infrastructure for PET bottles and containers, making it the most available source of recycled content. However, the Polypropylene (PP) segment is projected to be the fastest-growing product segment through the forecast to 2030. This rapid growth trend is fueled by advances in PP recycling technology, which is unlocking its potential for higher-value applications, particularly in the automotive and electrical & electronics sectors.

Growth Trends & Key Market Drivers

The market’s strong CAGR is underpinned by several critical key market drivers and pervasive growth trends:

-

Regulatory Mandates and EPR Schemes: The increasing implementation of Extended Producer Responsibility (EPR) laws and minimum recycled content mandates at state and federal levels in the US and Canada is the single most significant driver. These policies compel consumer goods brands and packaging manufacturers to integrate a fixed percentage of PCR material into their products, creating a mandated, consistent demand floor for recycled plastic.

-

Corporate Sustainability Commitments (ESG): Major multinational corporations across packaging, food & beverage, and consumer goods are publicly committing to ambitious Environmental, Social, and Governance (ESG) goals. These commitments often include targets for 100% reusable, recyclable, or compostable packaging and significant increases in recycled resin usage, accelerating the shift away from virgin plastic.

-

Technological Advancements in Recycling: Innovations in advanced recycling (or chemical recycling) are a key growth trend. Technologies such as pyrolysis and depolymerization are enabling the processing of mixed, contaminated, or hard-to-recycle plastics (like films and flexibles), yielding high-purity, near-virgin quality feedstocks. This is crucial for expanding the use of recycled material in demanding applications like food-grade packaging.

-

-

Consumer Preference: A rising environmental consciousness among North American consumers is translating into a strong preference for products with demonstrable sustainability credentials. This consumer demand provides a powerful market pull for brands to prioritize eco-friendly packaging and products made with recycled content.

Segment Analysis

The in-depth segment insights reveal where the most significant growth contribution and adoption trends are originating within the North American market.

By Type (Resin)

-

Polyethylene Terephthalate (PET): Dominates due to the beverage bottle recycling stream. Its applications span from new bottles (rPET) to fibers for textiles and strapping.

-

High-Density Polyethylene (HDPE): A significant contributor, driven by its use in non-food packaging (detergent bottles) and for durable goods like plastic lumber and pipes in the Building & Construction segment.

-

Polypropylene (PP): Expected to see the highest CAGR growth. Increased recycling of PP from automotive parts and consumer goods is boosting its use in crates, industrial components, and flexible packaging.

By Application/End-Use

The Packaging segment is the undisputed leader, accounting for the largest market share.

-

Packaging: High demand across food & beverage, personal care, and household goods for both rigid and flexible packaging materials. This segment is the primary consumer of rPET and rHDPE.

-

Automotive: Experiencing robust growth trends. Recycled plastics are increasingly used in vehicle components like interior panels, under-the-hood parts, and bumpers, driven by the industry’s push for lightweighting to improve fuel efficiency and meet sustainability targets.

-

Building & Construction: A steady market for recycled materials in non-structural applications, including plastic lumber, drainage pipes, decking, and insulation.

-

Textiles: Primarily uses rPET for manufacturing polyester fibers, contributing significantly to sustainable apparel and carpeting.

Competitive Landscape & Key Players

The North America recycled plastic competitive landscape is moderately fragmented, featuring a mix of large international waste management giants, pure-play recyclers, and chemical companies investing heavily in advanced recycling. Competition is fierce, focusing on securing high-quality feedstock, developing innovative processing technologies, and forging long-term supply partnerships with brand owners.

Key Players in the market are leveraging strategic initiatives:

-

Capacity Expansion: Major players like KW Plastics (a leader in HDPE and PP recycling), Plastipak Holdings, Inc., and Veolia Polymers are aggressively increasing their recycling infrastructure and output capacity to meet the soaring demand for recycled plastic.

-

Strategic Partnerships: Collaborations with major consumer packaged goods (CPG) companies (e.g., Coca-Cola, Kraft Heinz) to ensure a stable off-take for PCR content are common, helping to lock in market share.

-

Technological Investment: Companies like Agilyx and Brightmark LLC are focusing on advanced recycling to diversify their product portfolio beyond traditional mechanical recycling and supply high-purity material.

-

Geographic Expansion: Focusing on increasing processing capabilities in high-waste-generating areas across the US and Canada.

The collective strategy is to enhance the quality and reliability of recycled resin supply to directly compete with virgin plastic on both performance and price, a core aspect of solidifying market positioning.

Regional Insights (North America)

Within the global context, North America is a crucial market.

-

United States: Dominates the regional market size and market share. Growth is propelled by numerous state-level recycled content mandates, robust industrial consumption, and significant private sector investment in recycling infrastructure and technology.

-

Canada: Expected to demonstrate a high CAGR. Canada’s national strategy, including its goal to achieve zero plastic waste by 2030, and its advancing regulatory framework are powerful growth factors.

-

Mexico: An increasingly important market and feedstock source, with growing international investment focused on improving collection and processing capacity to serve North American brands.

Future Outlook & Forecast to 2030

The Future Outlook for the North America Recycled Plastic Market is exceptionally positive. The forecast to 2030 indicates that the market is transitioning from a niche industry into a core component of the regional economy. The major opportunities lie in:

-

Scaling Advanced Recycling: Successfully industrializing chemical recycling will unlock entirely new feedstock sources (mixed and difficult-to-recycle flexibles) and allow recycled plastic to meet the technical requirements for high-value uses like food-grade packaging, which currently face quality barriers with mechanical methods.

-

Infrastructure Investment: Significant investment in nationwide, standardized collection and sorting infrastructure (specifically for plastics beyond PET bottles) will be critical to ensuring a consistent, high-quality supply of feedstock.

With a projected CAGR of 8.7% and a market valuation approaching USD 17 billion by the end of the decade, the North America recycled plastic sector is set for transformative growth, driven by an irreversible shift toward corporate accountability and a genuine circular economy.

FAQ: People Also Ask About the North America Recycled Plastic Market

Q1: What is the current market size and expected growth of the North America Recycled Plastic Market?

The North America Recycled Plastic Market was valued at approximately USD 9.4 billion in 2023 and is projected to reach around USD 16.9 billion by 2030. This growth is forecast to occur at a Compound Annual Growth Rate (CAGR) of 8.7% during the 2024-2030 period.

Q2: What are the main growth factors driving the demand for recycled plastic in North America?

The primary growth factors are stringent government regulations (such as mandatory minimum recycled content), aggressive corporate sustainability goals (ESG commitments to use Post-Consumer Recycled/PCR material), and strong consumer demand for eco-friendly and circular packaging solutions.

Q3: Which segment holds the largest market share in terms of resin type?

Currently, Polyethylene Terephthalate (PET) holds the largest market share by resin type, primarily due to the efficient collection and recycling infrastructure for PET bottles. However, Polypropylene (PP) is expected to show the fastest growth rate.

Q4: Which end-use industry contributes the most to the North America Recycled Plastic Market's growth?

The Packaging end-use segment contributes the most to the market's growth, driven by the massive demand analysis for recycled content in food & beverage, personal care, and other consumer goods packaging. The Automotive segment is also a fast-growing contributor.

Q5: Who are the key players in the North America Recycled Plastic competitive landscape?

Key companies shaping the competitive landscape include major recyclers and waste management firms such as KW Plastics, Plastipak Holdings, Inc., Veolia Polymers, Agilyx, and Brightmark LLC, which are investing heavily in capacity expansion and advanced recycling technologies.

Q6: What are the key trends impacting the market forecast to 2030?

Key growth trends include the widespread implementation of Extended Producer Responsibility (EPR) schemes, a significant increase in the adoption of advanced (chemical) recycling to create food-grade PCR material, and continuous corporate investment in digital traceability and sorting infrastructure.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness