-

Fil d’actualités

- EXPLORER

-

Pages

-

Blogs

-

Courses

-

Film

Asset Management Market Research Report: Size, Share, Growth Factors, Trends & Forecast

"Executive Summary Asset Management Market Opportunities by Size and Share

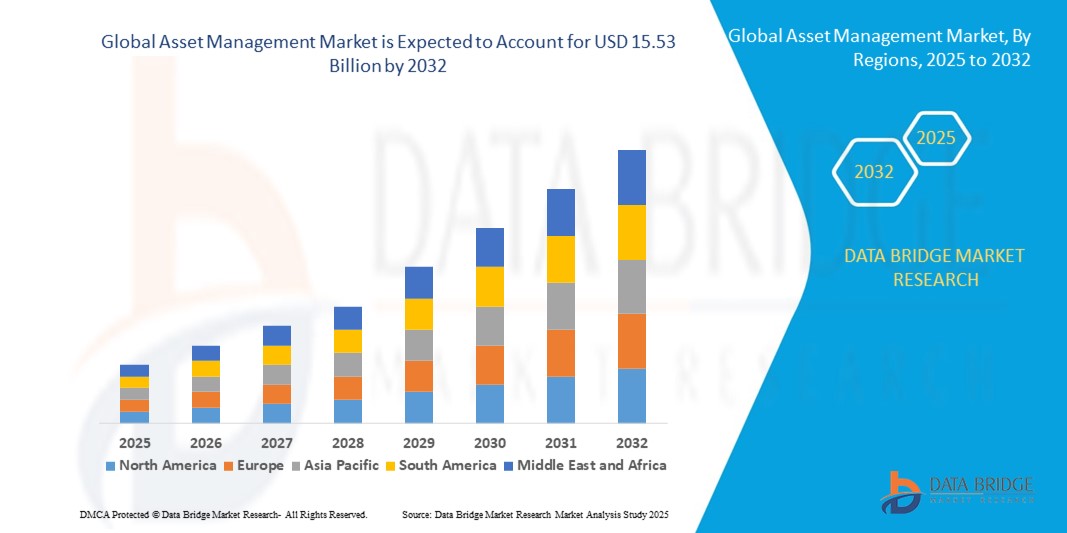

- The global asset management market size was valued at USD 5.84 billion in 2024 and is expected to reach USD 15.53 billion by 2032, at a CAGR of 13.0% during the forecast period

The leading Asset Management Market report is sure to guide in one or the other way to accomplish one of the most important goals of every business i.e. gaining maximum return on investment (ROI). To bring about the same, this market research report offers an insightful market data and information about Asset Management Market industry to businesses for making better decisions and defining business strategies. This business report contains a key data and information about the market, emerging trends, product usage, motivating factors for customers and competitors, restraints, brand positioning, and customer behaviour. All these factors are very noteworthy when it comes to achieve success in the competitive marketplace.

An influential Asset Management Market report includes strategic profiling of the major players in the market, comprehensive analysis of their fundamental competencies, and thereby keeps competitive landscape of the market in front of the client. Furthermore, details about historic data, present market trends, future product environment, marketing strategies, technological innovation, upcoming technologies, emerging trends or opportunities, and the technical progress in the related industry can also be gained via this market research report. With the correct utilization of excellent practice models and brilliant method of research, Asset Management Market survey report is prepared which aids businesses to uncover the greatest opportunities in the Asset Management Market industry.

Analyze top trends and market forces impacting the Asset Management Market. Full report ready for download:

https://www.databridgemarketresearch.com/reports/global-asset-management-market

Current Scenario of the Asset Management Market

Segments

- Asset Type: The global asset management market can be segmented based on the type of assets being managed, including equity, fixed income, real estate, commodities, and others. Asset managers specialize in managing different asset classes to meet the diverse needs of investors.

- Service Type: Asset management services can be classified into portfolio management, investment advisory, risk management, and others. Different service types cater to the specific requirements of clients, whether individual investors, institutions, or corporations.

- Application: The market can also be segmented based on the application of asset management services, such as wealth management, pension funds, insurance companies, and others. Each application segment has unique demands and regulatory considerations that impact the asset management industry.

Market Players

- BlackRock, Inc.: As one of the largest asset management firms globally, BlackRock offers a range of investment solutions across different asset classes. With a strong track record and diverse client base, BlackRock is a key player in the asset management market.

- Vanguard Group: Known for its low-cost index funds and ETFs, Vanguard Group is a prominent player in the asset management industry. Catering to both individual and institutional investors, Vanguard's passive investment strategies have gained popularity.

- UBS Group AG: UBS Group is a leading player in the asset management sector, offering wealth management services alongside its asset management offerings. With a global presence and expertise in managing diverse portfolios, UBS Group serves a wide range of clients.

- Fidelity Investments: Fidelity Investments is a well-known asset management firm that provides a range of investment products and services. With a focus on personalized advice and innovative solutions, Fidelity has established itself as a reputable player in the market.

- State Street Corporation: Specializing in institutional asset management and servicing, State Street Corporation is a key player in the financial services industry. With a focus on risk management and regulatory compliance, State Street caters to institutional clients globally.

The asset management market is witnessing a shift towards sustainable and responsible investing, driven by increasing awareness of environmental, social, and governance (ESG) factors among investors. This trend is reshaping the investment landscape, with asset managers incorporating ESG criteria into their investment strategies to meet the growing demand for socially responsible investments. As sustainability gains momentum, asset managers are developing ESG-focused products and services to align with investor values and address climate-related risks. This shift towards sustainable investing is not only driven by ethical considerations but also by the potential for long-term financial performance, as companies with strong ESG practices are increasingly seen as more resilient and better positioned for sustainable growth.

Another emerging trend in the asset management market is the growing adoption of technology and data analytics to enhance investment decision-making processes. Asset managers are increasingly leveraging artificial intelligence, machine learning, and big data analytics to gain insights, identify trends, and optimize investment portfolios. By harnessing the power of technology, asset managers can improve risk management, enhance performance attribution, and provide more personalized investment solutions to clients. The integration of technology also enables asset managers to automate routine tasks, streamline operations, and reduce costs, ultimately enhancing efficiency and competitiveness in the market.

Moreover, the asset management market is facing regulatory challenges, particularly in terms of compliance with changing regulatory requirements and standards. Regulatory scrutiny is increasing in the asset management industry, necessitating firms to adapt to evolving regulatory frameworks to ensure transparency, accountability, and investor protection. Compliance with regulations such as MiFID II, GDPR, and AIFMD poses challenges for asset managers in terms of data privacy, reporting obligations, and governance practices. Firms that prioritize regulatory compliance and adopt robust risk management processes will be better positioned to navigate regulatory complexities and maintain the trust and confidence of investors.

Furthermore, the COVID-19 pandemic has accelerated digital transformation in the asset management industry, prompting firms to reevaluate their operational resilience, business continuity plans, and client engagement strategies. The shift to remote work environments has underscored the importance of digital tools, cybersecurity measures, and agile infrastructure in supporting uninterrupted service delivery and communication with clients. Asset managers that invest in technology, cybersecurity, and digital capabilities will be better equipped to adapt to evolving market dynamics, mitigate operational risks, and seize opportunities for growth in a post-pandemic world.

In conclusion, the asset management market is undergoing significant transformations driven by sustainable investing trends, technology adoption, regulatory challenges, and the impact of the COVID-19 pandemic. Asset managers that embrace sustainability, leverage technology, prioritize regulatory compliance, and enhance operational resilience will be well-positioned to navigate the evolving landscape, meet client needs, and drive long-term success in the market.The asset management market is witnessing a paradigm shift driven by sustainability trends, technological advancements, regulatory pressures, and the post-pandemic ecosystem. Sustainability is a key driver reshaping investment strategies, with a focus on ESG criteria becoming mainstream as investors seek socially responsible opportunities. Asset managers are aligning their products and services with ESG principles to cater to the growing demand for sustainable investments, which not only align with ethical values but are also increasingly viewed as financially beneficial in the long run.

Technology adoption is another pivotal trend impacting the asset management landscape, with AI, machine learning, and data analytics revolutionizing investment decision-making processes. Asset managers are leveraging technology to enhance risk management, optimize portfolios, and offer personalized solutions to investors. By embracing advanced technologies, asset managers can streamline operations, reduce costs, and improve efficiency, ultimately gaining a competitive edge in the market.

Regulatory challenges pose a significant hurdle for asset managers, with evolving standards and requirements demanding firms to enhance transparency, governance, and compliance practices. The increased regulatory scrutiny, particularly regarding data privacy, reporting obligations, and investor protection, necessitates asset managers to stay abreast of changing frameworks to maintain trust and credibility with stakeholders. Those firms that prioritize regulatory compliance and robust risk management processes will mitigate potential regulatory risks and demonstrate their commitment to operating ethically and responsibly.

The COVID-19 pandemic has catalyzed digital transformation efforts within the asset management industry, emphasizing the importance of operational resilience, cybersecurity, and client engagement strategies. Remote work environments have underscored the necessity of digital tools and agile infrastructure to ensure seamless service delivery and communication with clients. Asset managers that invest in technology, cybersecurity, and digital capabilities will possess a competitive advantage in adapting to evolving market dynamics, managing operational risks, and seizing growth opportunities in the post-pandemic era.

In conclusion, the asset management market is experiencing a profound evolution shaped by sustainable investing, technological innovations, regulatory complexities, and the repercussions of the COVID-19 pandemic. Embracing sustainability, leveraging technology, ensuring regulatory compliance, and fortifying operational resilience are critical imperatives for asset managers seeking to thrive in this dynamic environment. By staying attuned to these transformative trends and harnessing them strategically, asset managers can navigate challenges, meet investor expectations, and pave the way for sustained success in the competitive landscape of asset management.

Access segment-wise market share of the company

https://www.databridgemarketresearch.com/reports/global-asset-management-market/companies

Targeted Question Batches for Asset Management Market Exploration

- What is the estimated size of the Asset Management Market right now?

- How much is the Asset Management Market expected to expand annually?

- What are the principal segments featured in the study?

- Who are the prominent companies shaping the Asset Management Market?

- What are some of the latest offerings introduced by key players?

- Which global regions are considered in the market study?

- Which region has demonstrated the most accelerated growth?

- Which country is likely to outperform others in the market?

- What region has the highest current market share?

- Which country has the highest projected CAGR?

Browse More Reports:

Spain Commercial Dishwashers Market

Global Sulfuric Acid Market

Turkey Artificial Intelligence Market

U.A.E. Mushroom Cultivation Market

U.S. and Mexico Cat Litter Market

U.S. Energy Drinks Market

U.S. Potato Chips Market

Global Intelligent Transportation System (ITS) Market

Global Beauty Devices Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness