The Shift Toward Sustainable and Efficient Produced Water Solutions

Introduction

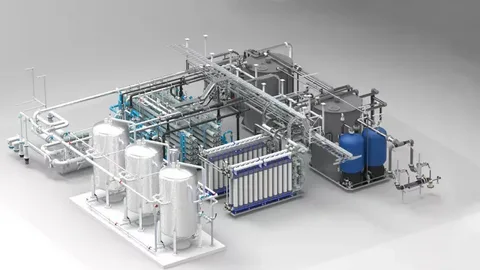

The Produced Water Treatment Market is becoming increasingly critical as global oil and gas production intensifies, generating large volumes of contaminated water that require treatment before reuse or discharge. Produced water is a by-product extracted during oil and gas operations and often contains hydrocarbons, chemicals, salts, heavy metals, and suspended solids. With rising environmental concerns, strict government regulations, and the need for sustainable water management, treatment technologies are gaining strong traction. Oilfield operators are shifting toward advanced treatment systems to reduce environmental impact, recover valuable resources, and lower water disposal costs. The market is projected to grow at a CAGR of nearly 7–8% over the forecast period, driven by increasing onshore and offshore exploration, technological advancements in filtration, membrane systems, and thermal treatment solutions. As industries move toward water recycling and zero-liquid discharge (ZLD), demand for cost-efficient, eco-friendly produced water treatment technologies continues to rise.

Market Drivers

Stringent government regulations and environmental policies are major drivers pushing oil and gas companies to adopt advanced produced water treatment solutions. Rising global energy demand is increasing exploration and production activities, thereby generating large volumes of produced water that require effective treatment. Growing focus on sustainable water management, reuse, and recycling is accelerating market adoption, especially in water-scarce regions. The cost of wastewater disposal is increasing due to transportation, deep-well injection restrictions, and rising regulatory penalties, encouraging companies to invest in on-site treatment systems. Advancements in membrane technologies, electrochemical processes, and automated filtration systems are improving treatment efficiency and lowering operating costs. Increasing offshore drilling activities and aging oil fields with higher water-to-oil ratios further boost the need for efficient treatment solutions.

Market Challenges

High operational and installation costs associated with advanced treatment systems remain a key challenge, especially for small and mid-scale oilfield operators. Produced water composition varies significantly by geographic region, reservoir type, and production method, making standardized treatment difficult. Handling and treating water with high levels of salinity, dissolved organics, and radioactive materials requires complex, multi-stage processes, increasing technical challenges. Disposal restrictions, particularly on deep-well injection, are tightening globally, limiting affordable disposal options. Lack of skilled personnel to manage advanced filtration, membrane, and thermal systems also restricts adoption in developing regions. Additionally, fluctuating oil prices influence investment capacity in treatment infrastructure, with budget cuts during price downturns slowing market growth.

Market Opportunities

Growing adoption of water recycling, resource recovery, and circular water economy principles offers significant opportunities in the produced water treatment sector. Technologies enabling recovery of oil, minerals, and salt from produced water add economic value to treatment operations. Digitalization, IoT-based monitoring, and automation solutions enable real-time water quality tracking and predictive maintenance, increasing operational efficiency. The expansion of enhanced oil recovery (EOR) operations and unconventional oil and gas extraction, such as shale gas and tight oil, creates new demand for mobile and modular treatment units. Partnerships between technology providers and oil companies to develop cost-effective solutions for remote and offshore operations present new revenue streams. Emerging innovations such as advanced oxidation processes (AOPs), forward osmosis, membrane distillation, and low-energy desalination are expected to reshape the industry with more efficient and sustainable treatment methods.

Regional Insights

North America leads the global market due to large shale gas and tight oil production, particularly in the United States and Canada. The U.S. has a strong regulatory framework and high adoption of advanced treatment technologies due to high produced water volumes from the Permian Basin, Eagle Ford, and Bakken fields. The Middle East holds a significant share, driven by water scarcity and growing investments in water recycling to support oilfield operations. Europe is witnessing steady growth due to stricter environmental norms and advanced offshore drilling activities in the North Sea. The Asia-Pacific region is emerging as a fast-growing market with increasing oil and gas exploration in China, India, Indonesia, and Australia. Latin America and Africa are gradually adopting treatment solutions as investments in oil exploration increase, especially in Brazil, Argentina, and offshore African fields.

Future Outlook

The future of the Produced Water Treatment Market will be shaped by sustainability, resource recovery, and zero-liquid-discharge trends. More oilfield operators will adopt closed-loop water management systems to recycle and reuse treated water for drilling, enhanced oil recovery, and industrial applications. Technological advancements will continue to improve treatment efficiency, enabling removal of complex contaminants at lower energy consumption. Digital automation, AI-based predictive analytics, and smart monitoring systems will play a central role in optimizing treatment performance. Increasing collaboration among oil & gas producers, water technology companies, and environmental regulators will accelerate innovation. As global energy companies commit to carbon reduction and sustainable operations, produced water treatment will transition from a compliance requirement to a strategic priority, contributing to cost savings, environmental protection, and operational resilience.

Conclusion

The Produced Water Treatment Market is expanding rapidly as oil and gas producers adopt more efficient, sustainable, and regulation-compliant water management practices. With increasing environmental pressure, rising disposal costs, and growing focus on water reuse, treatment technologies are becoming essential across both onshore and offshore operations. While high installation costs, operational complexities, and varying water compositions pose challenges, ongoing technological advancements and increasing investments in automation, membrane systems, and digital water solutions are creating new growth opportunities. As the global oil and gas landscape moves toward environmentally responsible operations, produced water treatment will continue to evolve into a key strategic pillar enabling long-term sustainability, resource optimization, and reduced environmental impact.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness