0 Σχόλια

0 Μοιράστηκε

27 Views

0 Προεπισκόπηση

Κατάλογος

Ανακάλυψε νέους ανθρώπους, δημιούργησε νέες συνδέσεις και κάνε καινούργιους φίλους

-

Παρακαλούμε συνδέσου στην Κοινότητά μας για να δηλώσεις τι σου αρέσει, να σχολιάσεις και να μοιραστείς με τους φίλους σου!

-

How the Best SEO Company in Oxford Transforms Local BusinessesOxford has long been known for its historic spires, academic excellence, and a culture that thrives on tradition. But behind the cobblestones and heritage façades, a quieter revolution is underway. Small cafés, family-owned shops, professional firms, and even emerging tech startups are finding that their most valuable storefront is no longer on the high street—it’s on...0 Σχόλια 0 Μοιράστηκε 23 Views 0 Προεπισκόπηση

-

0 Σχόλια 0 Μοιράστηκε 16 Views 0 Προεπισκόπηση

-

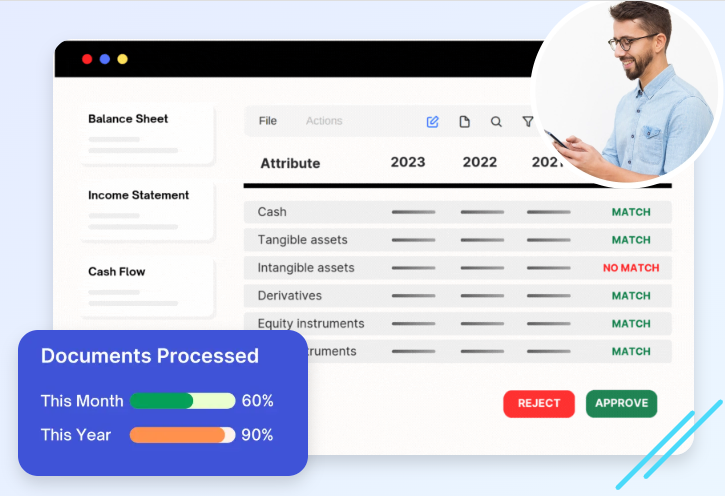

The Importance of Spreading Financials in Credit Analysis

Spreading financials is a critical process in banking and lending that involves transforming raw financial statements into a standardized format for analysis. By spreading financials, institutions can compare client performance across industries and time periods, ensuring more accurate credit risk assessments. This process allows analysts to identify key trends, assess liquidity, profitability, and leverage ratios, and make data-driven lending decisions. Traditionally done manually, spreading financials can be time-consuming and prone to errors. However, modern tools and automation have simplified the task, reducing risk while improving efficiency. For banks, lenders, and credit analysts, spreading financials is an essential step to ensure transparency, consistency, and reliability in financial decision-making.

Visit Us: https://scryai.com/collatio/financial-spreading/

The Importance of Spreading Financials in Credit Analysis Spreading financials is a critical process in banking and lending that involves transforming raw financial statements into a standardized format for analysis. By spreading financials, institutions can compare client performance across industries and time periods, ensuring more accurate credit risk assessments. This process allows analysts to identify key trends, assess liquidity, profitability, and leverage ratios, and make data-driven lending decisions. Traditionally done manually, spreading financials can be time-consuming and prone to errors. However, modern tools and automation have simplified the task, reducing risk while improving efficiency. For banks, lenders, and credit analysts, spreading financials is an essential step to ensure transparency, consistency, and reliability in financial decision-making. Visit Us: https://scryai.com/collatio/financial-spreading/ SCRYAI.COMFinancial SpreadingAutomate financial spreading with Collatio by Scry AI. Speed up credit analysis and improve accuracy using advanced document AI and data extraction tools.0 Σχόλια 0 Μοιράστηκε 19 Views 0 Προεπισκόπηση

SCRYAI.COMFinancial SpreadingAutomate financial spreading with Collatio by Scry AI. Speed up credit analysis and improve accuracy using advanced document AI and data extraction tools.0 Σχόλια 0 Μοιράστηκε 19 Views 0 Προεπισκόπηση -

0 Σχόλια 0 Μοιράστηκε 9 Views 0 Προεπισκόπηση

-

Connexify for Enterprises: Scalable Growth Made EasyIntroduction to Connexify In today’s fast-paced business landscape, enterprises are constantly seeking innovative solutions to drive growth and streamline operations. Connexify powerful platform designed specifically for organizations that aim to scale efficiently while maintaining a competitive edge. With its user-friendly interface and robust features, Connexify simplifies complex...0 Σχόλια 0 Μοιράστηκε 8 Views 0 Προεπισκόπηση